The Inflation Reduction Act (IRA) has been an active policy since August 16th, 2022. As the law has evolved, navigating this laws requires an understanding of how to structure projects to meet the requirements. Requirements for Inflation Reduction Act CO2 projects are governed by two sections of the law. 45Q covers the tax policies related to facilities sequestering CO2 and the rebates available to those companies based on how the CO2 is sequestered or used. Sunset timelines for 45Q are December 31st, 2032. 45Z is related to rebates for low-carbon fuel production, where CO2 capture can be used to reduce the carbon intensity of those fuels for a rebate. 45Z’s timeline is applicable for production between January 1st, 2024 and December 31st, 2027.

https://home.treasury.gov/policy-issues/inflation-reduction-act/ira-related-tax-guidance

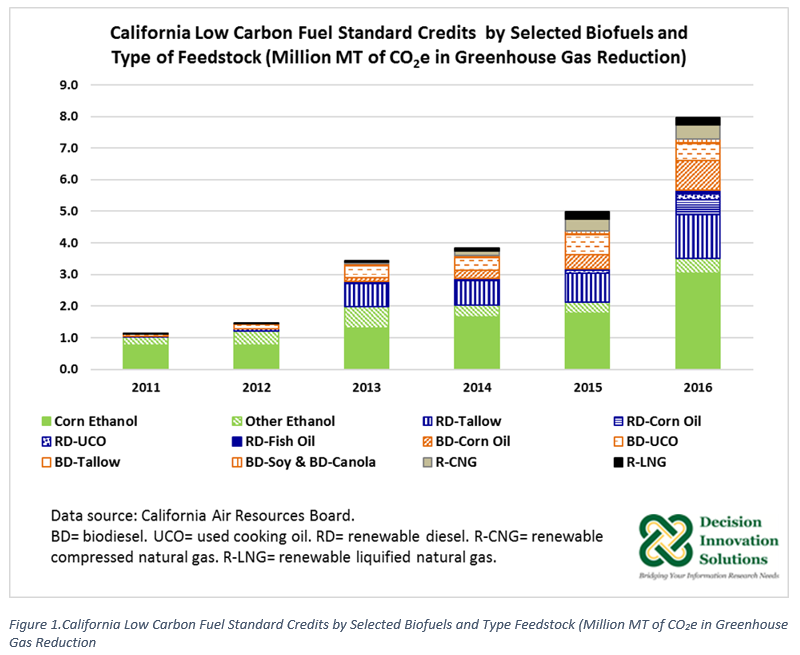

Chart provided by Decision Innovation Solutions – July 6th, 2017

As the industry has sought to utilize these rebates, comments and clarifications have been provided. We are sharing how some of those clarifications should be considered in your project execution of facilities and products making use of IRA rebates.

Implications in CO2 Facility Execution for IRA Rebates – 45Q and 45Z

There are two major factors in requirements for Inflation Reduction Act CO2 projects. Ensuring that your project considers these requirements and aligns with your contracting strategy for the facility is key to being able to claim the rebates for your project. Meeting these requirements can lead to 5x the rebate from the project, sometimes up to 50% of a project’s capital cost.

What is the prevailing wage and who governs it?

The prevailing wage is a locality-based wage measurement tracked by the Department of Labor.

“A prevailing wage is the combination of the basic hourly wage rate and any fringe benefits rate, paid to workers in a specific classification of laborer or mechanic in the geographic area where construction, alteration, or repair is performed, as determined by the Secretary of Labor in accordance with subchapter IV of chapter 31 of title 40 of the United States Code, also known as the Davis-Bacon Act.”

https://www.dol.gov/agencies/whd/IRA

The apprenticeship requirements have increased since the law was signed.

“Taxpayers shall ensure that, with respect to the construction of any qualified facility, not less than the applicable percentage of the total labor hours of the construction, alteration, or repair work (including such work performed by any contractor or subcontractor) with respect to such facility shall, subject to subparagraph (B), be performed by qualified apprentices.

In the case of a qualified facility the construction of which begins after December 31, 2023, 15 percent.”

https://www.law.cornell.edu/uscode/text/26/45#b_8

Managing Prevailing Wage and Apprenticeship Requirements for the IRA

Execution strategy can be used to limit exposure and ensure compliance for successful rebates. Focusing on the definition of a “qualified site” and a secondary site will allow projects to limit the scope that applies to the requirements. Clarifications to this were provided on June 25th by the Department of the Treasury.

https://www.federalregister.gov/documents/2024/06/25/2024-13331/increased-amounts-of-credit-or-deduction-for-satisfying-certain-prevailing-wage-and-registered

The structure of the contract terms, including penalty clauses and remediation for the failure to meet and document the requirements should be another focus of the project execution plan. Secure legal counsel who is familiar with this law and industrial contract negotiations for the review of the contracts. GrantThorton has some summaries on their website that convey they are experts in the matter and there are many other legal firms out there that can help.

https://www.grantthornton.com/insights/alerts/tax/2023/flash/irs-details-wage-and-apprenticeship-requirements

A Path to Successful CO2 Project Execution

All projects have similar milestones for evaluation, selection, funding, definition, and execution. During the project evaluation and selection process, discuss the IRA requirements. At CANUSA EPC, being transparent with the project stakeholders throughout the project allows the team to progress with the execution while staying aligned with the goals of the client. We don’t claim to provide problem free projects, but we do hold the expectations of our team and clients to work through the problems in a transparent manner.

Reach out if you have any questions or comments, and we will be happy to provide our expertise to your team. Project experience from CANUSA EPC related to CO2 can be found at our expertise page.