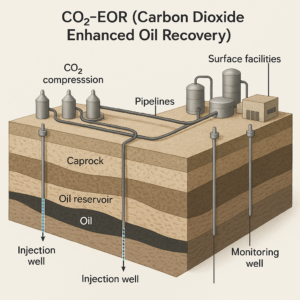

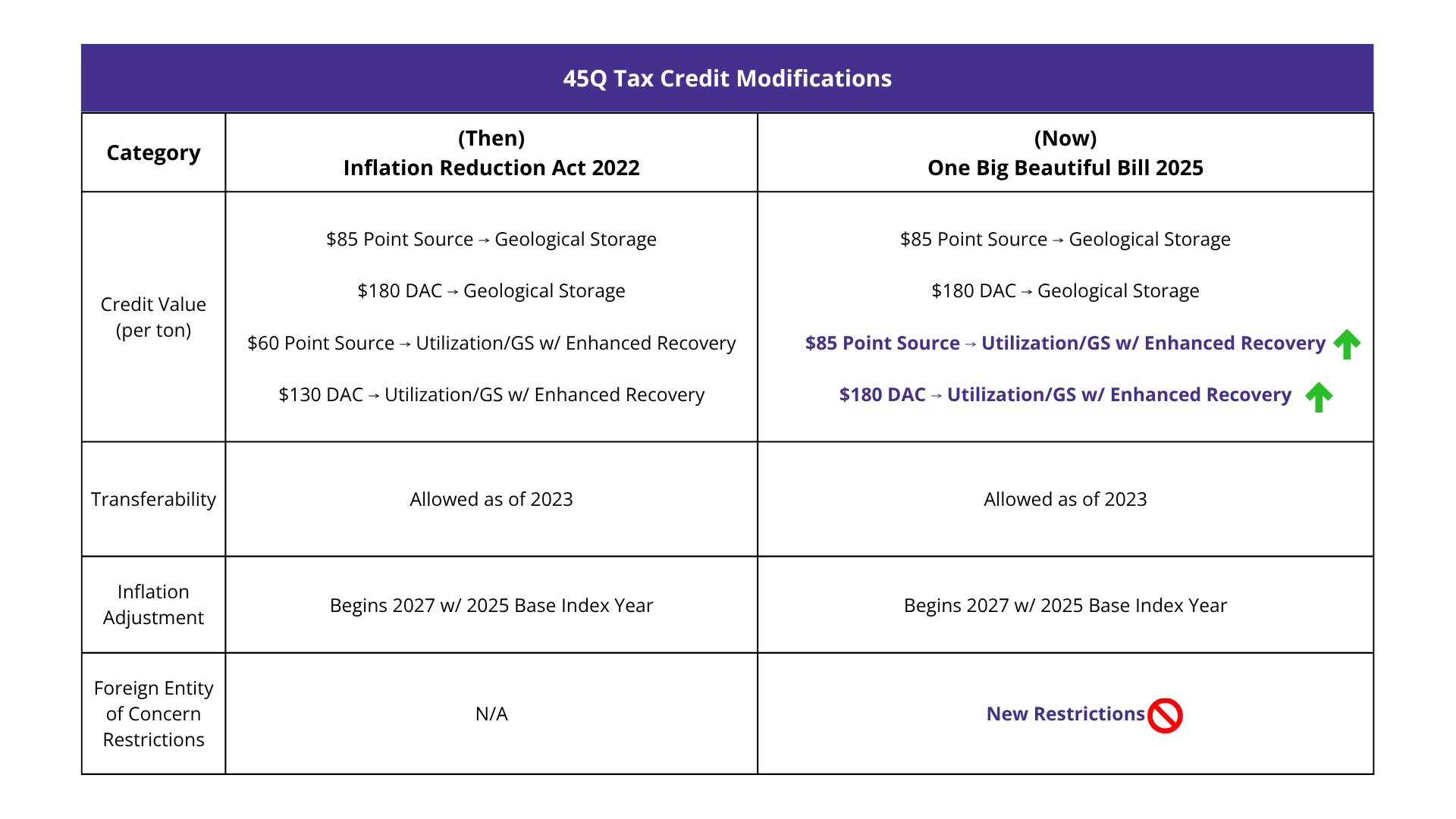

The recently passed One Big Beautiful Bill Act preserved and enhanced carbon capture and storage (CCS) opportunities. One of the most impactful provisions for carbon capture is the expansion of the 45Q tax credit to $85 per metric ton for CO₂ used in Enhanced Oil Recovery (EOR) when the CO₂ is permanently stored in geological formations.

This update significantly improves the financial outlook for oil and gas developers pursuing CO₂-EOR projects that meet geological sequestration criteria. In this article, we break down the implications of this policy shift and how project developers can capitalize on it.

What’s New in 45Q Under the One Big Beautiful Bill?

The One Big Beautiful Bill Act preserves and enhances the 45Q tax credit structure, with a critical clarification: CO₂ used in EOR now qualifies for the full $85/ton credit if it is geologically sequestered. This aligns EOR with saline storage projects in terms of credit value, provided the CO₂ is not vented or recycled but permanently stored underground in accordance with the EPA Class VI well regulations.

Key Provisions:

- $85/ton for CO₂ captured and geologically stored, including via EOR

- $60/ton remains for CO₂ used in EOR without geological storage

- Transferability and direct pay options remain intact

- No sunset clause, offering long-term certainty for developers

This change reflects growing recognition of EOR’s role in both emissions reduction and domestic energy production.

Three 45Q Benefits for CO2-EOR Project Developers

1. Higher Credit Value = Better IRR

The jump from $60 to $85/ton for qualifying EOR projects can significantly improve project economics. For example, a facility capturing 500,000 tons of CO₂ annually, means an additional $12.5 million/year in direct payments.

2. Geological Storage Is Now a Strategic Differentiator

Projects that integrate Class VI-compliant injection wells and robust monitoring, reporting, and verification (MRV) protocols can now access the higher credit tier. This incentivizes developers to design for permanence and compliance from day one.

3. Financing Becomes More Attractive

With higher credit values and continued transferability, tax equity investors are more likely to participate. This opens the door for alternative financing solutions like non-recourse project financing and joint ventures.

Modular Deployment Reduces Risk and Cost in 45Q-Qualified Projects

CO2 projects requirements still incentivize modular execution. Incorporating modular process packages and construction not only reduces risk related to field construction, it’s a strategic tool for moving scope that is governed by 45Q labor requirements onsite to offsite scope; providing lower costs overall and less liability due to prevailing wage.

Why Modular Execution Matters:

Reducing Risk for 45Q Wage Requirements

- Offsite labor is not subject to prevailing wage reporting or apprenticeship metrics, allowing the project to source market rate labor offsite and lowering the burden cost for the project.

- Only onsite labor requires detailed reporting for compliance tests for 45Q. Shifting scope to offsite locations reduced the cost of compliance.

Cost Control

- Onsite scope is exposed to risks from weather delays and increased mobilization costs to site. These costs can be better controlled in a fabrication facility, reducing contingency estimates for the project.

- Labor demands in regions are affected by activity from all operators and the limited local skill pool. Leveraging offsite fabrication allows for the scheduling of resources will limit risk to shortages.

Timeline Optimization for 45Q Eligibility

- Developers can begin construction on initial modules to meet IRS “begin construction” rules under Safe Harbor, securing eligibility while continuing to develop the rest of the project.

CANUSA EPC’s execution model brings practical modularization to your project. Read more about some of our projects using modular approaches such as the Helium Multiwell Purification Battery or 50 MMSCFD Gas Compressor Station.

Technical Requirements for Qualifying CO₂-EOR Projects

According to the DOE’s CCUS Appendix H, projects must meet several technical criteria to qualify for the $85/ton credit:

- High-purity CO₂ supply (typically >95%)

- Compression systems capable of delivering CO₂ at 1,200–2,200 psi

- Reservoirs with sufficient porosity and caprock integrity

- EPA Class VI injection wells for geological storage

- MRV plans approved by the EPA or equivalent state authority

Developing a low-cost injection project requires selection of the proper dehydration approach for water-saturated CO2. CANUSA EPC has released dehydration studies for CO2 projects, helping you select the correct technology for your CO2 project.

Strategic Recommendations for CO2 EOR Evaluations

- Determine Key Performance Metrics: Execute a FEED study to determine the proper metrics for financial investment; levelized cost per mton of CO2 product, carbon intensity to capture and process the CO2, and utility requirements.

- Leverage Modular EPC Execution: Accelerate lead times, improve cost control, and reduce compliance costs with modularized systems.

- Engage Tax Equity Partners Early: The $85/ton credit makes your project more bankable — capitalize on it.

- Audit Your CO₂ Source: Ensure your CO₂ stream meets purity and volume thresholds to qualify.

Conclusion

The One Big Beautiful Bill Act has solidified the opportunity landscape for CO₂-EOR projects. By extending the $85/ton 45Q credit to EOR with geological storage, it rewards projects that combine carbon mitigation with energy production. For developers ready to meet the technical and regulatory requirements, the path to profitability just got a lot clearer.

Ready to design a CO₂-EOR project that qualifies for $85/ton?

Connect with us to explore FEED support, modular compression systems, and turnkey EPC execution tailored for carbon capture and EOR.

PAPER AUTHORS

Forrest Churchill

External Sources:

https://www.congress.gov/bill/119th-congress/house-bill/1/text

https://www.epa.gov/uic/final-class-vi-guidance-documents

https://energy.sustainability-directory.com/term/non-recourse-financing/

https://www.energy.gov/sites/default/files/2022-10/CCUS-Appendix_H-030521.pdf

https://www.globalccsinstitute.com/news-media/latest-news/u-s-preserves-and-increases-45q-credit-in-one-big-beautiful-bill-act/